Cash flow per share formula

PE Ratio Price Per Share of the Company Earnings Per Share of the Company. A general measure of the companys ability to pay its debts uses operating cash flows and can be calculated as follows.

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow from Operations Formula in Excel With Excel Template Cash Flow from Operations Formula.

. To calculate cash flow per share Cash flow per share of the company shows the cash flow portion of the company allocated against each of the common stock presents in the company. As you can see. As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain.

Free Cash Flow Formula in Excel With excel template Here we will do the example of the Free Cash Flow Formula in Excel. Read more we need two things. Present value of FCFE is then dividend by the total number.

Cash is an important element for business it is required for the functioning of business some investor give more to cash. When performing financial analysis operating cash flow should be used in conjunction with net income free cash flow FCF and other metrics to properly assess a companys performance and financial health. It is very easy and simple.

DCF analyses use future free cash flow projections and discounts them using a. A financial ratio that indicates how much a company pays out in dividends each year relative to its share price. Also the firm can bifurcate the same into three major activities.

75000 0 11000 -19000 45000. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Many financial analysts place more emphasis on the.

As we said a Cash Flow Diagram is an essential element of your financial analysis. Calculating Cash Flow. The other months share a similar trend in cash balance with minor ups and downs.

Get All The Features For Free. Cash Flow Coverage Ratio Operating Cash Flows Total Debt. Operating Cash Flow Capital Expenditure and Net Working Capital.

For easy reference you can compare the dividends to the net earnings per share EPS in the same period. Free cash flow per share is a measure of a companys financial flexibility that is determined by dividing free cash flow by the total number of shares outstanding. When we combine earnings per share and price of the share for analysis we come across very widely useful metrics ie.

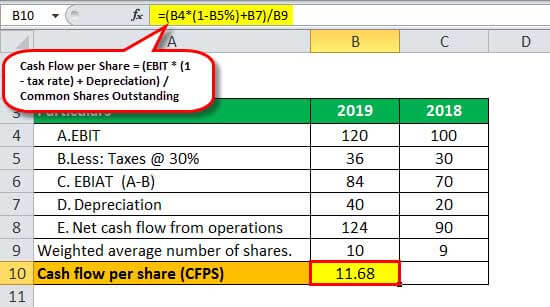

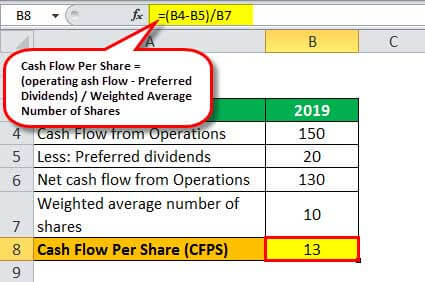

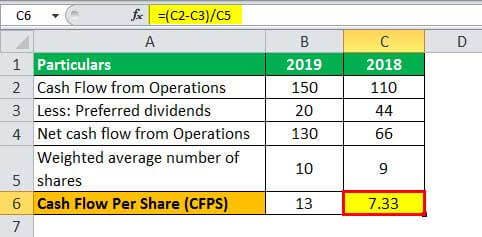

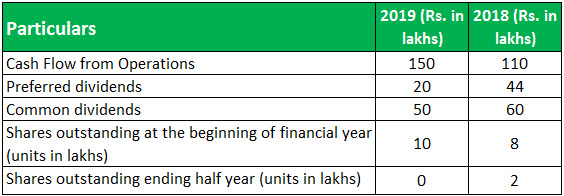

Cash flow per share is the after-tax earnings plus depreciation on a per-share basis that functions as a measure of a firms financial strength. Cash flow per share operating cash flow preferred dividendsWeighted average number of shares. Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity.

If earnings per share are used along with the price of the share it gives a fair view of the valuation of the share of a company. Dividend yield is represented as a percentage and can be calculated. Statement of Cash Flows Example.

Free Cash Flow to Equity Formula Starting from FCFF. Dumfries News Dumfries and Galloway old folk buying less food to save money for energy bills A survey of Food Train members has revealed heartbreaking and alarming feedback from the elderly. Learn how to analyze a statement of cash flow in CFIs Financial Analysis Fundamentals Course.

We care about the privacy of our clients and will never share your personal information with any third parties or persons. Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. FCF represents the cash that a company.

In their financial statements is a section that outlines the dividends declared per common share. You need to provide the three inputs ie. Below is an example from Amazons 2017 annual report which breaks down the cash flow generated from operations investing and financing activities.

FCFE is calculated as per the formula given in the post 3. There are a few different ways to calculate the cash flow coverage ratio formula depending on which cash flow amounts are to be included. Your operating cash flow formula is represented by.

The higher the earnings per share EPS the more profitable the company is. Cash flow from operation is cash generated from operational activities like manufacturing or selling goods and services etc. The formula for operating cash flow can be derived by using the following steps.

Below is an example from GEs 2017 annual report. In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed assets known as capital expenditures. We offer the lowest prices per page in the industry with an average of 7 per page.

045 x 14286 06429 dividend per share. Free Cash Flow - FCF. The net Cash Flow formula is a very useful equation as it allows the firm or the company to know the amount of cash generated whether its positive or negative.

As of October 3 2017 the company had 218 million in current assets and 384 million in current liabilities for a negative working capital balance of -166 million. First we need to know the. Operating Cash Flow Example.

Firstly determine the operating income of the company from the income statement. You can easily calculate the Free Cash Flow using the Formula in the template provided. Youre seeing a steady rental demand for these units all of which stay occupied most of the time but well calculate a 6 vacancy and non-payment risk to anticipate real cash flow just to be prudent.

Below is an example of operating cash flow OCF using Amazons 2017 annual report. FCFE Formula FCFF Interest x 1-tax Net Borrowings. New equity issuance means new shares issued.

The big drivers of the. Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures. Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts.

Importance of a Cash Flow Chart. Current Ratio and Quick Ratio. The real impact comes on the per share value calculated.

Example of Dividend per Share. The payment of a dividend is also treated as a financing cash flow. This measure serves as a proxy.

It is the income generated from the business before paying off interest and taxes. It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without causing issues in its.

Cash Flow Per Share Formula Example How To Calculate

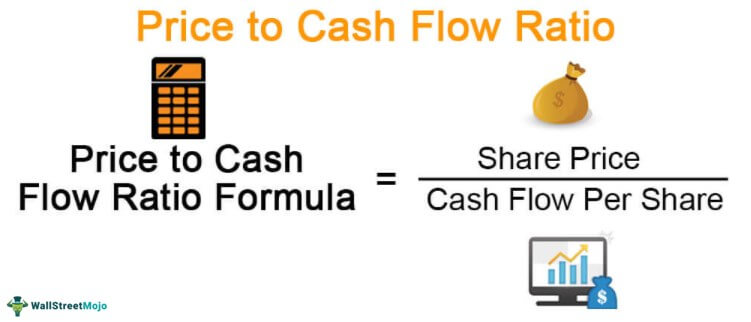

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Per Share Formula And Calculator Excel Template

Free Cash Flow Formula Calculator Excel Template

Operating Cash Flow Ratio Definition And Meaning Capital Com

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Per Share Formula And Calculator Excel Template

Price To Cash Flow Ratio Formula Example Calculation Analysis

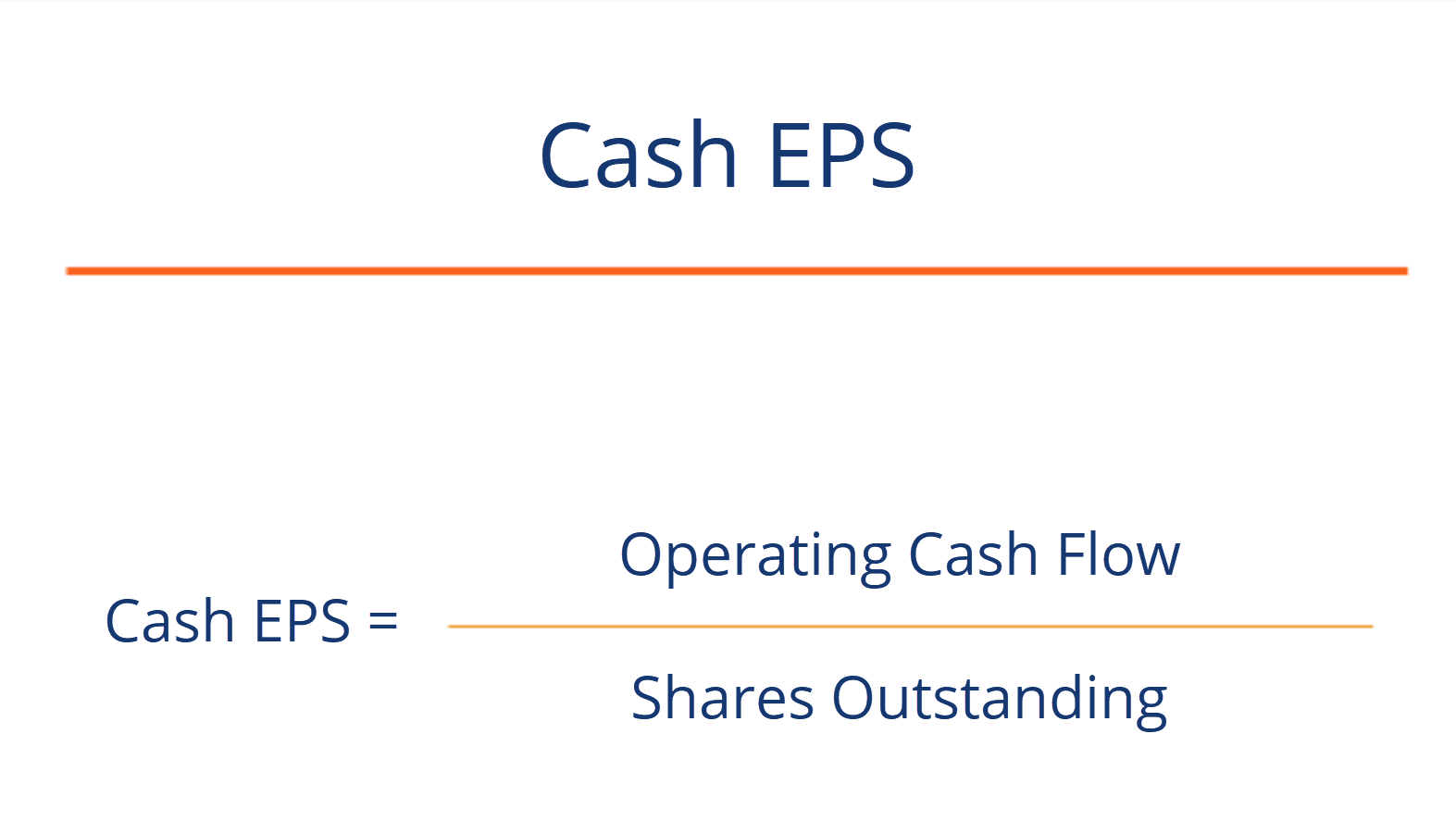

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cash Flow Formula How To Calculate Cash Flow With Examples